on Posted on Reading Time: 3 minutes

Service providers throughout the world are ready to implement the newly standardized MEF 3.0 LSO Sonata APIs to automate the manual processes required for inter-provider business connections. Initial implementations of Sonata APIs are focused on helping to streamline how customers order Carrier Ethernet services, which includes verifying service availability and price quoting. Ultimately, the goal for investing in MEF LSO Sonata is ‘frictionless commerce’ across all market players.

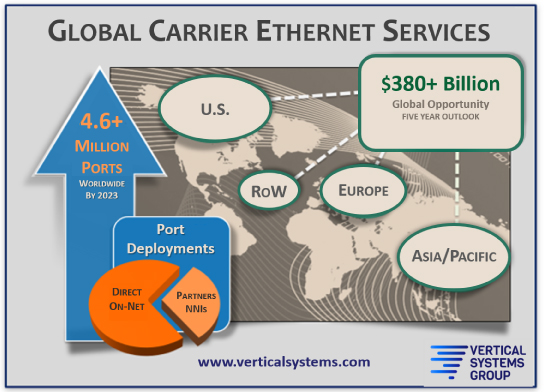

Global Carrier Ethernet Outlook

Carrier Ethernet is the right service to tackle first. With a five-year aggregate global revenue outlook of $380+ billion, Carrier Ethernet continues to be the largest and most strategic wireline data network service, according to the latest research from Vertical Systems Group. By 2023, 4.6+ million retail Ethernet ports will be installed at customer sites worldwide, including more than one million new ports deployed during the next several years. In the U.S. market, customer migration to Gigabit services is driving growth based on latest ENS @Ethernet research .

Most Ethernet services are delivered directly on-net with customer sites connected to a service provider’s own network infrastructure. However, every network provider’s service footprint has geographic limitations. For service delivery to off-net sites, network providers have long relied on wholesale partnerships, based on proprietary bilateral NNI (Network-to-Network Interface) or MEF ENNI (External Network-to-Network Interface) agreements. While this non-standard approach has worked for decades, it’s becoming unworkable as service providers virtualize their network operations to deliver dynamic service offerings that depend on flexible connectivity.

Challenges of Global Networks

The Global Provider segment of the Ethernet market is particularly dependent on managing the deployment of off-net connections. Vertical Systems Group defines Global Providers as network operators that support customers with multinational Ethernet networks. These networks span up to thousands of sites and may be located in one hundred or more different countries. The larger the network scope, the more likely there are gaps in a provider’s service availability footprint.

Leading Global Providers have hundreds of NNI agreements in place for buying and selling Ethernet services. Providers from different countries must consider not only the technical and business terms of an agreement, but also country-specific regulatory requirements.

Vertical’s Mid-Year 2019 Global Provider Ethernet LEADERBOARD ranks Global Providers based on retail market share as of June 30, 2019. Market share for this segment includes the global portion of providers’ networks—i.e., the ports outside of each service provider’s home country.

Global Providers attaining a position on the mid-2019 Ethernet LEADERBOARD are as follows (with home country and in rank order):

- AT&T (U.S.)

- Colt (U.K.),

- CenturyLink (U.S.)

- BT Global (U.K.)

- Orange Business (France)

- Verizon (U.S.)

- NTT (Japan)

Additionally, 8 companies qualified for the mid-2019 Challenge Tier ( in alphabetical order):

- Cogent (U.S.)

- Global Cloud Xchange (India)

- GTT (U.S.)

- SingTel (Singapore)

- T-Systems (Germany)

- Tata Communications (India)

- Telefonica Worldwide (Spain)

- Vodafone (U.K.)

Enabling Frictionless Commerce

An example of frictionless commerce is the ability to check Ethernet service availability and pricing in multiple countries using industry-standard APIs. This is a significant benefit for both buyers and sellers. It’s also a reason why Global Providers are among the most eager to advance the adoption of Sonata APIs.

More than 50 service providers worldwide have expressed support for LSO Sonata API development and adoption, including AT&T, Colt, CenturyLink, Orange Business Services, Verizon, Tata Communications, Telefonica, Vodafone, PCCW Global, Sparkle, and others. Many are now actively investing in real world implementations.

AT&T and Colt are already using Sonata APIs that enable automated service ordering between the two companies. Realized benefits they cite include reduced delivery time, operational efficiencies and a better business relationship.

Benefits and Challenges

The business benefits and challenges of implementing LSO Sonata APIs are starting to be uncovered. Want to hear the details? Join me and an outstanding panel of speakers at MEF19 for the session, Achieving Frictionless Commerce – The Business Case for Implementing LSO Sonata APIs for Inter-Provider Service Automation.